| | | | | | (5) | | Total fee paid: | | | | | | | | | | | | | | | | | ¨ | 5) Total fee paid: |

| | | | oFee paid previously with preliminary materials. |

| | | ¨ | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | 1) | (1) | | Amount Previously Paid: |

| | | | | | 2) | (2) | | Form, Schedule or Registration Statement No.: |

March 26, 2009

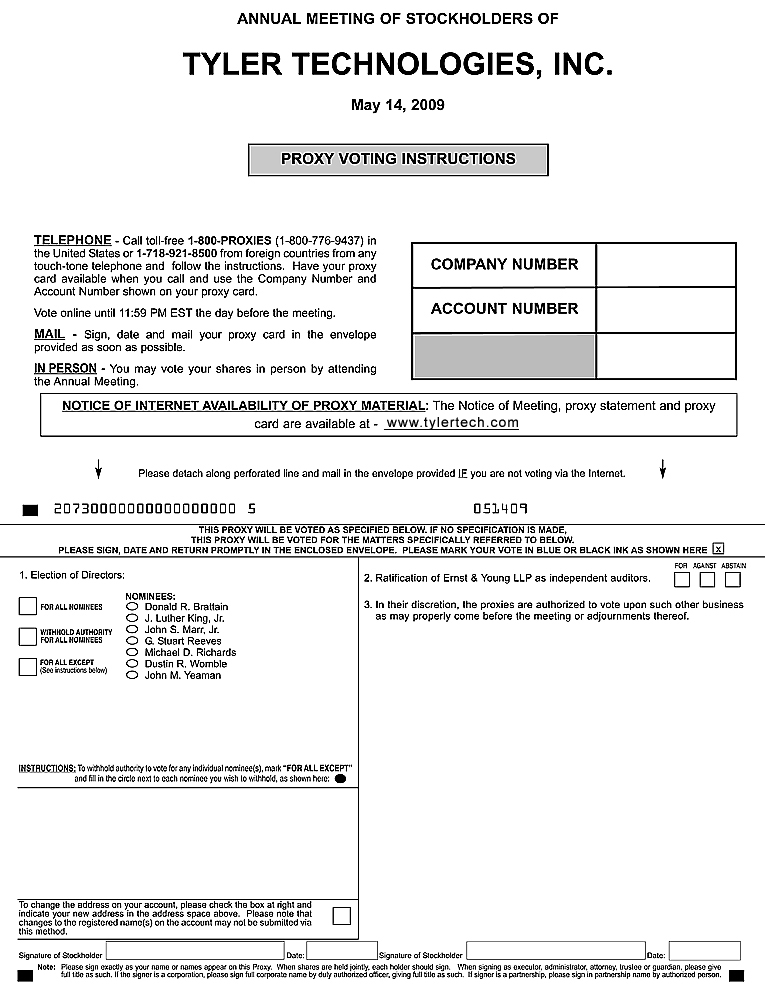

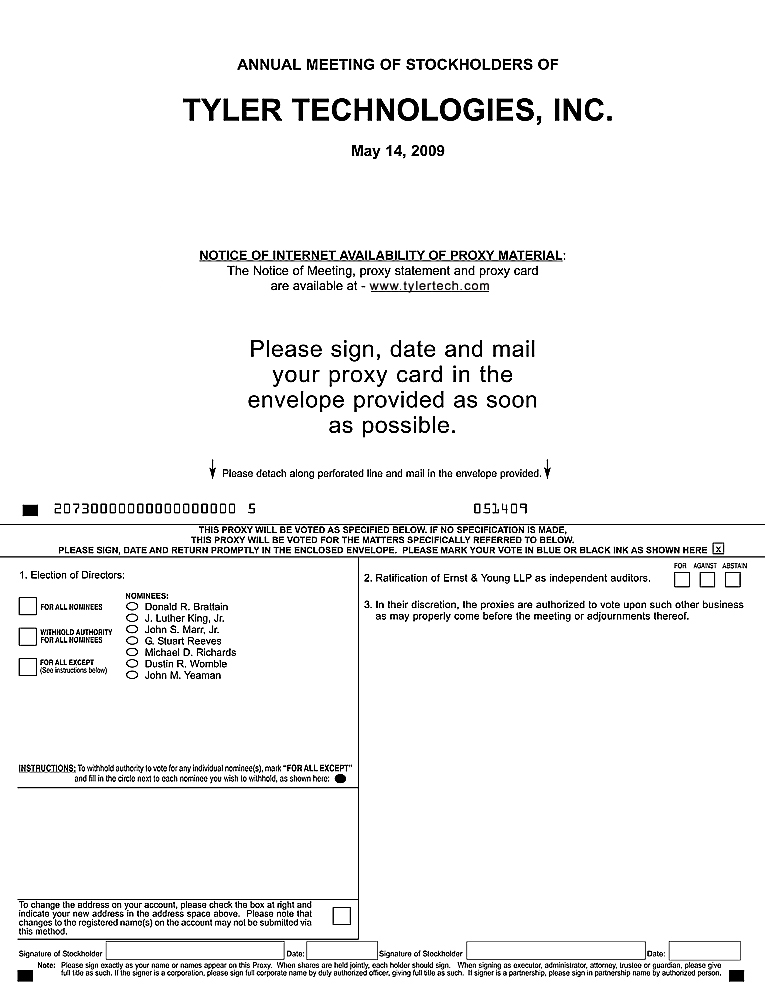

April 10, 2012Dear Stockholder: You are cordially invited to attend the annual meeting of stockholders of Tyler Technologies, Inc. to be held on Thursday, May 14, 2009,10, 2012, in Dallas, Texas at theThe Park City Club, 5956 Sherry Lane, Suite 1700,17th Floor, commencing at 9:30 a.m., local time. Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting and Proxy Statement. Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to sign, date, and return the enclosed proxy or vote through the Internet at your earliest convenience. If you decide to attend the annual meeting, you will be able to vote in person, even if you have previously submitted your proxy. On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of the Company. | | | | | Yours very truly,

| | /s/ JOHN M. YEAMAN

| | JOHN M. YEAMAN | Chairman of the Board

| | | | | | | | | | |

TYLER TECHNOLOGIES, INC.5949 Sherry Lane, Suite 1400 Dallas, TX 75225 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 14, 200910, 2012 TYLER TECHNOLOGIES, INC.: The annual meeting of stockholders will be held in Dallas, Texas at theThe Park City Club, 5956 Sherry Lane, Suite 1700,17th Floor, at 9:30 a.m., local time. At the meeting, you will be asked to: | | (1) | | elect seven directors to serve until the next annual meeting or until their respective successors are duly elected and qualified; | |

| | (2) | consider and vote upon a proposal to amend and restate the Tyler Technologies, Inc. 2004 Employee Stock Purchase Plan (the “ESPP”), increasing the number of shares of our common stock subject to the ESPP by 1,000,000; |

| (3) | ratify the selection of Ernst & Young LLP as our independent auditors for fiscal year 2009;2012; and | |

| | (3) | (4) | transact such other business as may properly come before the meeting. |

Only stockholders of record on March 17, 200916, 2012 may vote at the annual meeting. A list of those stockholders will be available for examination at our corporate headquarters, 5949 Sherry Lane, Suite 1400, Dallas, Texas 75225, from May 51 through May 14, 2009. 10, 2012.Please date and sign the enclosed proxy card and return it promptly in the enclosed envelope or vote through the Internet as described inon the enclosed proxy card.No postage is required if the proxy card is mailed in the United States. Your prompt response will reduce the time and expense of solicitation. The enclosed 20082011 Annual Report does not form any part of the proxy solicitation material. | | | | | | By Order of the Board of Directors

| | /s/ H. Lynn Moore, Jr.

| | H. Lynn Moore, Jr. | Executive Vice President,

| General Counsel, and Secretary

| | | | | | | | | | | |

Dallas, Texas

March 26, 2009 1April 10, 2012

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

to be held May 14, 2009

TABLE OF CONTENTS 2Appendix A – Tyler Technologies, Inc. 2004 Employee Stock Purchase Plan (Amended and Restated Effective June 1, 2012)

THE ANNUAL MEETING Place, Date, and TimeGeneral Information

The annual meeting will be held in Dallas, Texas at theThe Park City Club, 5956 Sherry Lane, Suite 1700,17th Floor, on Thursday, May 14, 2009,10, 2012, at 9:30 a.m., local time. Matters to be Considered

At the annual meeting, you will be asked to consider and vote upon the following proposals: | • | | Proposal One —Proposal One – Election of seven directors to serve until the next annual meeting or until their respective successors are duly elected and qualified; and | | | • | | Proposal Two — Ratification of the selection of Ernst & Young LLP as our independent auditors for fiscal year 2009. |

Record Date and Votingqualified;

Proposal Two – Approval of the amendment and restatement of the ESPP (the “Amended ESPP) increasing the number of shares of common stock subject to issuance under the ESPP from 1,000,000 to 2,000,000; and Proposal Three – Ratification of the selection of Ernst & Young LLP as our independent auditors for fiscal year 2012. At the 2011 annual meeting, a majority of the votes cast by our stockholders were voted, on an advisory basis, in favor of holding future stockholder voting on executive compensation every three years. Our Board of Directors decided to follow our stockholders’ recommendation; therefore, an advisory vote on executive compensation will not be submitted to our stockholders until the 2014 annual meeting. Only stockholders of record on March 17, 200916, 2012 are entitled to vote at the annual meeting. On March 17, 2009,16, 2012, we had 35,252,63030,084,000 shares of common stock issued and outstanding. Each stockholder will be entitled to one vote, in person or by proxy, for each share of common stock held in his or her name. A majority of our shares of common stock must be present, either in person or by proxy, to constitute a quorum for action at the annual meeting. If your shares are held in “street name” (the name of a broker, bank, or other nominee), you have the right to direct your broker, bank, or nominee how to vote. If you do not provide voting instructions, under New York Stock Exchange rules, your broker, bank, or nominee may only vote your shares on “discretionary” items. Proposal Three regarding ratification of our independent auditors is considered a discretionary item and may be voted in the absence of instructions. Proposals One (election of directors) and Two (approval of the Amended ESPP) are, however, “non-discretionary” items. Your broker, bank, or nominee may not vote your shares on these non-discretionary items in the absence of voting instructions, which will result in “broker non-votes” with respect to your shares. Abstentions and broker nonvotesnon-votes are counted for purposes of determining a quorum. Abstentions are counted in tabulating the votes cast on any proposal, but are not counted as votes either for or against a proposal. Broker nonvotesnon-votes are not counted as votes cast for purposes of determining whether a proposal has been approved. This proxy statement and accompanying form of proxy are first being sent to stockholders on or about April 10, 2012.

Vote Required

The following is the required vote necessary to approve each of the proposals:

| • | | Proposal One — Election of Directors — the election of directors is determined by plurality vote; and | | | • | | Proposal Two — Ratification of Ernst & Young LLP — the affirmative vote of holders of a majority of the voting power of the shares actually voted at the annual meeting is required to ratify Ernst & Young LLP as our independent auditors for fiscal year 2009. |

Proxy Solicitation, Revocation, and Expense The accompanying proxy is being solicited on behalf of the boardBoard of directors.Directors. Your shares will be voted at the annual meeting as you direct in the enclosed proxy or through the Internet, provided that itthe proxy is completed, signed, and returned to us prior to the annual meeting. No proxy can vote for more than seven nominees for director. If you return a proxy but fail to indicate how you wish your shares to be voted, then your shares will be voted in favor of each of the nominees for director. After you sign and return your proxy, you may revoke it prior to the meeting either by (i) filing a written notice of revocation at our corporate headquarters, (ii) attending the annual meeting and voting your shares in person, or (iii) delivering to us another duly executed proxy that is dated after the initial proxy. We will bear the expense of preparing, printing, and mailing the proxy solicitation material and the proxy. In addition to use of the mail, we may solicit proxies by personal interview or telephone by our directors, officers, and employees. We may also engage the services of a proxy solicitation firm to assist us in the solicitation of proxies. We estimate that the fee of any such firm will not exceed $10,000 plus reimbursement of reasonable out-of-pocket expenses. Arrangements may also be made with brokerage houses and other custodians, nominees, and fiduciaries for the forwarding of solicitation material to record stockholders, and we may reimburse them for their reasonable out-of-pocket expenses. 3

PROPOSALS FOR CONSIDERATION Proposal One —– Election of Directors At the annual meeting, you will be asked to elect a board of seven directors. The election of directors shall be determined by plurality vote. The nominees for director are: Donald R. Brattain; J. Luther King, Jr.; John S. Marr, Jr.; G. Stuart Reeves; Michael D. Richards; Dustin R. Womble; and John M. Yeaman. Each of the nominees currently serves on our boardBoard of directors.Directors. For more information regarding these nominees and their qualifications, see “Tyler Management.” Each nominee has indicated that he is able and willing to serve as a director. If any of the nominees becomes unable to serve prior to the meeting, the persons named in the enclosed proxy will vote the shares covered by your executed proxy for a substitute nominee as selected by the boardBoard of directors.Directors. You may withhold authority to vote for any nominee by entering his name in the space provided on the proxy card. Our boardBoard of directorsDirectors unanimously recommends that the stockholders voteFOR each of the nominees for director. Proposal Two —– Approval of the Amended ESPPAt the annual meeting, you will also be asked to consider and vote on a proposal to approve the Amended ESPP. The affirmative vote of holders of a majority of the voting power of the shares actually voted at the annual meeting is required to approve the Amended ESPP. If approved by the stockholders, the Amended ESPP will be effective on June 1, 2012. The following is a summary of the major terms of the Amended ESPP. A copy of the Amended ESPP is attached asAppendix A. Overview of the Amended ESPP On May 6, 2004, our stockholders approved the adoption of the ESPP. On February 23, 2012, our Board of Directors approved, subject to stockholder approval, the Amended ESPP and the reservation of additional shares of common stock for issuance under the Amended ESPP. The Amended ESPP is a broad-based plan intended to continue to encourage our employees to invest in our common stock. We believe that such an investment strengthens the commitment of all our employees to our long-term growth and profitability. The plan, in conjunction with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), achieves this goal by allowing our employees to purchase our common stock at an attractive price and by creating incentives for them to hold such stock as a long-term investment. Currently, there are only 129,243 shares of common stock available for issuance under the ESPP, which expires on December 31, 2014. The proposed Amended ESPP increases the number of shares of common stock subject to the plan from 1,000,000 to 2,000,000 and eliminates the expiration date. The number of shares that initially would be available for issuance under the Amended ESPP represents approximately 4% of our common stock currently outstanding. The Amended ESPP would terminate at the earlier of (1) its termination by our Board of Directors or (2) the date on which all shares of our common stock available for issuance under the ESPP have been issued. The increase in the number of authorized shares and the elimination of a fixed term (which was ten years in the original ESPP) are the principal changes reflected in the Amended ESPP. Administration The Amended ESPP is administered by the Board of Directors. The Board has the power, subject to the provisions of the plan, to determine when and how rights to purchase our common stock will be granted, the provisions of each offering of purchase rights, and whether any parent or subsidiary corporation of the Company will be eligible to participate in the ESPP. The Board is authorized to delegate administration of the plan to a committee designated by the Board. Eligibility and Employee Contributions The Amended ESPP, if approved by the stockholders, is intended to satisfy the requirements of Section 423 of the Code. The plan will allow all of our employees, and employees of any subsidiary corporations that participate in the plan, who have been employed for at least six months, and who are customarily employed for more than 20 hours per week, to authorize after-tax payroll deductions at any whole percentage rate from 1% to 15% of cash compensation paid during an offering period (regular base wages or salary and overtime pay, in each case before deduction for pre-tax contributions to a plan governed by Sections 401(k) or 125 of the Code) to be applied toward the purchase of our common stock. It is expected that employees of any non-U.S. subsidiaries will not be eligible to participate in the plan. As of March 16, 2012, there were approximately 2,115 employees eligible to participate in the plan. Offerings The Amended ESPP is implemented through sequential offerings, each of which is referred to as an “offering,” the terms of which are referred to as “offering periods.” Separate three-month offerings commence on January 1, April 1, July 1, and October 1 of each year, unless the Board of Directors otherwise determines. An employee must authorize a payroll deduction before the start of an offering in order to participate in that offering. On the last business day of the offering, the employee will be deemed to have exercised the right to purchase as many shares as the employee’s payroll deduction will allow at the purchase price. The purchase price will be established by our Board of Directors; provided, however, that the purchase price will not be less than 85% of the fair market value of our common stock as reported on the New York Stock Exchange on the last business day of the offering. Unless otherwise provided by our Board of Directors prior to the commencement of an offering period, the purchase price for that offering period will be 85% of the fair market value as of the purchase date. Fractional shares will not be purchased; instead, excess funds will be refunded to the employee or retained in the employee’s plan account to be applied toward the purchase of shares of our common stock in the subsequent offering. No employee may purchase more than 750 shares of stock during any single offering. In addition, an employee will not be permitted to purchase any shares under the Amended ESPP if the employee, immediately after the purchase, would own shares possessing 5% or more of the total combined voting power or value of our common stock. The fair market value of all shares purchased by an employee under the plan during any calendar year may not exceed $25,000, which is based on the fair market value of our common stock at the beginning of each offering period, and we may in our discretion suspend an employee’s payroll deductions to avoid accumulating amounts in excess of this limit. Employees may not sell any shares purchased for a period of at least 180 days after the purchase, unless the employee is terminated during this holding period. All shares purchased under the Amended ESPP must be held in designated accounts during this holding period. Employees will be responsible for all commissions related to future sales. Employees must notify us of the date and terms of any actual sale that occurs within two years of the beginning of the offering period in which the shares were acquired. Withdrawal An employee may withdraw at any time prior to two weeks before the last day of the offering period. Upon withdrawal, the amount in the employee’s account will be refunded to the employee without interest. An employee may suspend participation in an offering at any time before the two-week period ending on the last day of the offering period by reducing his or her payroll deduction percentage election to 0% for the remainder of the offering. In such a case, the amount accumulated in the employee’s account prior to the suspension is not refunded, but is used to purchase shares as described above. An employee who has withdrawn from or suspended participation in an offering may not again participate in the plan until the next offering commences. Termination of Employment Generally, if a participant’s employment terminates for any reason (including death, disability, or change in status) prior to a purchase date, his or her right to purchase shares of common stock under the plan, including during the current offering period, will immediately terminate and all of his or her payroll deductions for offering period in which the purchase right terminates will be refunded as soon as practicable. A terminated participant may again become eligible to participate in the plan if he or she returns to active service as an eligible employee. Restrictions on Transfer Purchase rights granted under the Amended ESPP are not transferable other than by will or the laws of descent and distribution and shall be exercisable during the lifetime of a participant only by the participant. Amendment and Termination Our Board of Directors may at any time amend or terminate the Amended ESPP, provided that no employee’s existing rights under any offering already commenced may be adversely affected thereby. Any amendment will be consistent with applicable law, including first obtaining the prior approval of our stockholders if the amendment would increase the number of shares reserved for issuance under the plan or materially modify the eligibility requirements. The Amended ESPP will terminate at the discretion of our Board of Directors or in the event all shares reserved for issuance under the plan have been purchased, whichever occurs first. Federal Income Tax Consequences Relating to the Amended ESPP The Amended ESPP is intended to qualify under the provisions of Section 421 and Section 423 of the Code. Under the Code, we are deemed to grant employee participants in the plan an “option” on the first day of each offering period to purchase as many shares of common stock as the employee will be able to purchase with the payroll deductions credited to his or her account during the offering period. Accordingly, for purposes of this tax consequences discussion, we refer to “options” and related terms. On the last day of each offering period, the purchase price is determined and the employee is deemed to have exercised the “option” and purchased the number of shares his or her accumulated payroll deductions will purchase at the purchase price, subject to the limitations of the plan. No income will be taxable to a participant at the time of grant of the option or purchase of shares. However, a participant may become liable for tax upon dispositions of shares acquired under the plan, and the tax consequences will depend on how long a participant has held the shares prior to disposition. If the shares are disposed of (1) at least two years after the date of the beginning of the offering period and (2) at least one year after the stock is purchased in accordance with the plan (or, if the employee dies while holding the shares), the following tax consequences will apply. The lesser of (a) the excess of fair market value of the shares at the time of such disposition over the purchase price of the shares (the “option price”), or (b) the excess of the fair market value of the shares at the time the option was granted over the option price will be taxed as ordinary income to the participant. Any further gain upon disposition generally will be taxed at long-term capital gain rates. If the shares are sold and the sales price is less than the option price, there is no ordinary income and the participant has a long-term capital loss equal to the difference. If a participant holds the shares for the holding periods described above, we will not be allowed a federal income tax deduction for the amount determined to be ordinary income to the participant. If the shares are sold or disposed of (including by way of gift) before the expiration of either the two-year or one-year holding periods described above, the following tax consequences will apply. The amount by which the fair market value of the shares on the date the option is exercised (i.e., the last business day of the offering period or the “termination date”) exceeds the option price will be taxed as ordinary income to the participant. This excess will constitute ordinary income in the year of the sale or other disposition even if no gain is realized on the sale or a gratuitous transfer of the shares is made. The balance of any gain will be taxed as a capital gain and will qualify for long-term capital gain treatment if the shares have been held for more than one year following the exercise of the option. If the shares are sold for an amount less than their fair market value as of the termination date, the participant recognizes ordinary income equal to the excess of the fair market value of the shares as of the termination date over the exercise price, and the participant may recognize a capital loss equal to the difference between the sales price and the value of such shares on the termination date. In the event of an early disposition, we will be allowed a deduction for federal income tax purposes equal to the ordinary income realized by the disposing employee. Currently, we are not required to withhold employment or income taxes upon the exercise of the options under the plan pursuant to Section 423 of the Code. THE FOREGOING SUMMARY OF THE EFFECT OF THE FEDERAL INCOME TAX UPON PARTICIPANTS IN THE AMENDED ESPP DOES NOT PURPORT TO BE COMPLETE, AND IT IS RECOMMENDED THAT THE PARTICIPANTS CONSULT THEIR OWN TAX ADVISORS FOR COUNSELING. MOREOVER, THE FOREGOING SUMMARY IS BASED UPON PRESENT FEDERAL INCOME TAX LAWS AND IS SUBJECT TO CHANGE. THE TAX TREATMENT UNDER FOREIGN, STATE, OR LOCAL LAW IS NOT COVERED IN THIS SUMMARY. New Plan Benefits Because the number of shares that may be purchased under the Amended ESPP will depend on each employee’s voluntary election to participate and on the fair market value of our common stock at various future dates, the actual number of shares that may be purchased by any employee, including our executive officers, cannot be determined in advance. In addition, the number of shares that any executive officer may purchase is, as discussed above, subject to the limitation of 750 shares in any single offering and the calendar-year limitation of $25,000 in fair market value. No shares of our common stock have been issued with respect to the additional 1,000,000 shares reserved for issuance subject to stockholder approval of the Amended ESPP pursuant to this proposal. Our Board of Directors unanimously recommends that the stockholders voteFOR the approval of the Amended ESPP. Proposal Three – Ratification of Ernst & Young LLP as Our Independent Auditors for Fiscal Year 20092012 The Audit Committee has selected Ernst & Young LLP, independent registered public accounting firm, as our independent auditors for fiscal year 2009,2012, subject to ratification by the stockholders. The affirmative vote of holders of a majority of the voting power of the shares actually voted at the annual meeting is required to ratify Ernst & Young LLP as our independent auditors for fiscal year 2012. Ernst & Young LLP served as our independent auditors for fiscal years 20082011 and 2007.2010. A representative of Ernst & Young LLP is expected to be present at the annual meeting. That representative will have an opportunity to make a statement, if desired, and will be available to respond to appropriate questions. | | | Ernst & Young’s fees for all professional services during each of the last two fiscal years were as follows: |

| | | | | | | | | | | | | 2008 | | | 2007 | | | | | Audit Fees | | $ | 1,095,000 | | | $ | 1,069,000 | | | Audit Related Fees | | | 63,000 | | | | 51,000 | | | Tax Fees | | | 19,000 | | | | 11,000 | | | | | | | | | | | Total | | $ | 1,177,000 | | | $ | 1,131,000 | |

Ernst & Young's fees for all professional services during each of the last two fiscal years were as follows: | | | | | | | | | | | | 2011 | | | 2010 | | Audit Fees | | $ | 971,000 | | | $ | 1,054,000 | | Audit Related Fees | | | 32,000 | | | | 25,000 | | Tax Fees | | | 70,000 | | | | 44,000 | | | | | | | | | | | Total | | $ | 1,073,000 | | | $ | 1,123,000 | |

Audit Fees. Fees for audit services include fees associated with the annual audit, the review of our interim financial statements, and the auditor’s opinions related to internal control over financial reporting required by Section 404 of the Sarbanes-Oxley Act. Audit-Related Fees. Fees for audit-related services generally include fees for accounting consultations and Securities and Exchange Commission (“SEC”) filings. Tax Fees. Fees for tax services include fees for tax consulting and tax compliance. All Other Fees. We did not engage Ernst & Young LLP for any other services in 2011 or 2010. The Audit Committee approved all of the independent auditor engagements and fees presented above. Our Audit Committee Charter requires that the Audit Committee pre-approve all audit and non-audit services provided to us by our independent auditors. All such services performed in 20082011 were pre-approved by the Audit Committee. For more information on these policies and procedures, see “Corporate“Board of Directors and Corporate Governance Principles and Board Matters —– Pre-Approval Policies and Procedures for Audit and Non-Audit Services.” Our boardBoard of directorsDirectors unanimously recommends that the stockholders voteFOR the ratification of Ernst & Young LLP as our independent auditors for fiscal year 2009.2012. 4

TYLER MANAGEMENT Directors, Nominees for Director, and Executive Officers Below is a brief description of our directors, nominees for director, and executive officers. Each director holds office until our next annual meeting or until his successor is elected and qualified. Executive officers are elected annually by the boardBoard of directorsDirectors and hold office until the next annual board meeting or until their successors are elected and qualified. | | | | | | | Name / Age | | Present Position | | Served Since | | | Name / Age | | Present Position | | Served Since | | | | | | | | | John M. Yeaman, 6871 | | Chairman of the Board Director | | | 2004 1999 | | | John S. Marr, Jr., 52 | | President and Chief Executive Officer Director | | 2004 2002 | | | Donald R. Brattain, 71 | | Director | | | 1999 | | John S. Marr, Jr., 492004 | | President and Chief Executive Officer | | | 2004 | | J. Luther King, Jr., 72 | | Director | | | 20022004 | | | Donald R. Brattain, 68G. Stuart Reeves, 72 | | Director | | | 20042001 | | | J. Luther King, Jr., 69Michael D. Richards, 61 | | Director | | | 2004 | | G. Stuart Reeves, 692002 | | Director | | | 2001 | | Michael D. Richards, 58 | | Director | | | 2002 | | Dustin R. Womble, 4952 | | Executive Vice President | | | 2003 | | | | | Director | | | 2005 | | | Brian K. Miller, 5053 | | Executive Vice President | | | 2008 | | | | | Chief Financial Officer | | | 2005 | | | | | Treasurer | | | 1997 | | | H. Lynn Moore, Jr., 4144 | | Executive Vice President | | | 2008 | | | | | Secretary | | | 2000 | | | | | General Counsel | | | 1998 | | |

Business Experience of Directors, Nominees for Director, and Executive Officers John M. Yeamanhas served as Chairman of the Board since July 2004. From April 2002 until July 2004, Mr. Yeaman served as President and Chief Executive Officer; from March 2000 until April 2002, he served as President and Co-Chief Executive Officer; and from December 1998 until March 2000, he was President and Chief Executive Officer. Mr. Yeaman was elected to our boardBoard of directorsDirectors in February 1999. Mr. Yeaman also serves as Chairman of the Executive Committee. From 1980 until 1998, Mr. Yeaman was associated with Electronic Data Systems Corporation (“EDS”), where he most recently served as the director of a worldwide Strategic Support Unit managing $2 billion in real estate assets.. Mr. Yeaman began his career with Eastman Kodak Company. Mr. Yeaman also serves on the Board of Directors of Park Cities Bank in Dallas, Texas. John S. Marr, Jr.has served as President and Chief Executive Officer since July 2004. From July 2003 until July 2004, Mr. Marr served as Chief Operating Officer. Mr. Marr has served on our boardBoard of directorsDirectors since May 2002 and is currently a member of the Executive Committee. Mr. Marr also served as President of MUNIS, Inc. (“MUNIS”) from 1994 until July 2004. Mr. Marr began his career in 1983 with MUNIS, a provider of a wide range of software products and related services for county and city governments, schools, and not-for-profit organizations, with a focus on integrated financial systems. We acquired MUNIS in 1999. Mr. Marr also serves on the board of directors of Mercy Hospital in Portland, Maine. Donald R. Brattainhas served as a director since 2004. Mr. Brattain also serves as Chairman of the Audit Committee and is a member of the Nominating and Governance Committee. Since 1985, Mr. Brattain has served as President of Brattain & Associates, LLC, a private investment company founded by Mr. Brattain in 1985 and located in Minneapolis, Minnesota. From 1981 until 1988, Mr. Brattain purchased and operated Barefoot Grass Lawn Service Company, a company that grew from $3.2 million in sales to over $100 million in sales and was sold to ServiceMaster, Ltd. in 1998. J. Luther King, Jr.has served as a director since 2004. Mr. King also serves on the Audit Committee and the Compensation Committee. Mr. King is the Chief Executive Officer and President of Luther King Capital 5

Management, (“LKCM”), a registered investment advisory firm that he founded in 1979. Mr. King also serves as a director and a member of the Audit Committee of Encore Energy Partners GP, LLC. In addition, Mr. King serves as a director onin leadership positions with various private and non-profit entities and foundations, including Chairman of the Board of Trustees of Texas Christian University Advisory Committee(member of theBoard of Trustees), Employees Retirement System of Texas Trustee(member of Investment Advisory Committee), and LKCM Funds and director of Hunt Forest Products, Inc.(trustee). Mr. King has a Bachelor of Science degree and a Masters of Business Administration from Texas Christian University, and he is also a Chartered Financial Analyst. G. Stuart Reeveshas served on our boardBoard of directorsDirectors since June 2001. Mr. Reeves also serves as Chairman of the Nominating and Governance Committee and is a member of the Audit Committee and the Compensation Committee. From 1967 to 1999, Mr. Reeves worked for EDS, a professional services company that offers its clients a portfolio of related systems worldwide within the broad categories of systems and technology services, business process management, management consulting, and electronic business.company. During his thirty-two32 years of service with EDS, Mr. Reeves held a variety of positions, including the following: Executive Vice President, North and South America, from 1996 to 1999;America; Senior Vice President, Europe, Middle East, and Africa, from 1990 to 1996;Africa; Senior Vice President, Government Services Group, from 1988 to 1990;Group; Corporate Vice President, Human Resources, from 1984 to 1988;Resources; Corporate Vice President, Financial Services Division, from 1979 to 1984;Division; Project Sales Team Manager, from 1974 to 1979;Manager; and Systems Engineer and Sales Executive, from 1967 to 1974. Mr. Reeves also served on the EDS Board of Directors from 1988 until 1996.Executive. Mr. Reeves retired from EDS in 1999. Mr. Reeves serves on the Board of Directors of Park Cities Bank in Dallas, Texas. Mr. Reeves has Bachelor of Science and Master of Science degrees in Mathematics from Oklahoma State University. Michael D. Richardshas served on our boardBoard of directorsDirectors since May 2002. Mr. Richards also serves as Chairman of the Compensation Committee and is a member of the Nominating and Governance Committee. Mr. Richards is Executive Vice PresidentChief Operating Officer of Republic Title of Texas, Inc. From September 2000 until September 2005, Mr. Richards served as Chairman and Chief Executive Officer of Suburban Title, LLC d/b/a Reunion Title, an independent title insurance agency founded by Mr. Richards in September 2000 and which he sold to Republic Title in September 2005. From 1989 until September 2000, Mr. Richards served as President and Chief Executive Officer of American Title Company, Dallas, Texas, an affiliate of American Title Group, Inc., one of the largest title insurance underwriters in Texas during that time. From 1982 until 1989, Mr. Richards held various management positions with Hexter-Fair Title Company, Dallas, Texas, including President from 1988 until 1989. From 1974 until 1982, Mr. Richards worked for Stewart Title Guaranty Company, Dallas, Texas, during which time he held several key management positions including serving on its board of directors. Mr. Richards holds several positions with various associations, some of which include: Greater Dallas Chamber of Commerce, member of the Economic Development Advisory Council; Leukemia Society of America, Advisory Board Member; Greater Dallas Association of Realtors, Board Member; Home Builders Association, Board Member; and member of the executive committee of the Texas Stampede. Dustin R. Womblehas been Executive Vice President in charge of corporate-wide product strategy Chief Executive Officer of both our Courts and Justice division and our INCODE division since July 2006 and2006. He is currently a member of the Executive Committee. From July 2003 to June 2006, Mr. Womble was Executive Vice President in charge of corporate-wide product strategy and President of our INCODE division.Local Government Division. Mr. Womble founded and previously served as President of our INCODE divisionLocal Government Division (formerly INCODE) from 1998, when we acquired INCODE, to July 2003. Brian K. Millerhas been Executive Vice President —– Chief Financial Officer and Treasurer since February 2008. From May 2005 until February 2008, Mr. Miller served as Senior Vice President —– Chief Financial Officer and Treasurer. He previously served as Vice President —– Finance and Treasurer from May 1999 to April 2005 and was Vice President —– Chief Accounting Officer and Treasurer from December 1997 to April 1999. From June 1986 through December 1997, Mr. Miller held various senior financial management positions at Metro Airlines, Inc. (“Metro”), a publicly-held regional airline holding company operating as American Eagle. Mr. Miller was Chief Financial Officer of Metro from May 1991 to December 1997 and also held the office of President of Metro from January 1993 to December 1997. Mr. Miller is a certified public accountant. H. Lynn Moore, Jr.has been General Counsel since September 1998, and has been Secretary since October 2000, and Executive Vice President since February 2008. He previously served as Vice President from October 2000 until February 2008. From August 1992 to August 1998, Mr. Moore was associated with the law firm of Hughes & Luce, L.L.P. in Dallas, Texas where he represented numerous publicly-held and privately-owned entities 6

in various corporate and securities, finance, litigation, and other legal related matters. Mr. Moore is a member of the State Bar of Texas. Board Diversity and Nominee Qualifications Our Corporate Governance Guidelines include the criteria our Board of Directors believes are important in the selection of director nominees, which includes the following qualifications: sound personal and professional integrity; an inquiring and independent mind; practical wisdom and mature judgment; broad training and experience at the policy-making level of business, finance and accounting, government, education, or technology; expertise that is useful to Tyler and complementary to the background and experience of other board members, so that an optimal balance of board members can be achieved and maintained; willingness to devote the required time to carrying out the duties and responsibilities of board membership; commitment to serve on the board for several years to develop knowledge about our business; willingness to represent the best interests of all stockholders and objectively appraise management performance; and involvement only in activities or interests that do not conflict with the director’s responsibilities to Tyler or our stockholders. In identifying nominees for director, the Board of Directors focuses on ensuring that it reflects a diversity of experiences and backgrounds that will complement our business and enhance the function of the Board. The Board prefers a mix of background and experience among its members. The Board has not adopted a formal policy with respect to its consideration of diversity and does not follow any ratio or formula to determine the appropriate mix; rather, it uses its judgment to identify nominees whose backgrounds, attributes, and experiences, taken as a whole, will contribute to the high standards of board service. Our Board of Directors is composed of seven individuals, consisting of four independent directors and three employee directors. We believe the mix of outside experience from our independent directors coupled with the specific industry experience of our employee directors provides an appropriate diversity of experience to effectively manage our business. In addition, each independent director has extensive chief executive officer experience with businesses of varying size in various industries. Some independent directors have direct public company experience, while others have smaller, private company experience. Each director has valuable experience in building and sustaining a successful business enterprise. The Nominating and Governance Committee believes that the above-mentioned attributes, along with the leadership skills and other experiences of its board members described below, provide us with the perspectives and judgment necessary to guide our strategies and monitor their execution: | | | | | | Donald R. Brattain | | – | | Private investment management experience as President of Brattain & Associates, LLC | | | – | | Executive and entrepreneurial experience in growth of a small business enterprise from $3.2 million in sales to over $100 million in sales | | | | | J. Luther King, Jr. | | – | | Executive equity management experience as founder of Luther King Capital Management, a registered investment advisory firm | | | – | | Outside board experience as a past director of Encore Energy Partners GP, LLC and other institutions | | | – | | Experience as a university trustee | | | | | G. Stuart Reeves | | – | | Extensive public company leadership experience with 32 years of service at EDS in various senior level capacities | | | – | | Outside board experience as a former director of EDS | | | | | Michael D. Richards | | – | | Executive and entrepreneurial experience as founder of Suburban Title LLC | | | – | | Outside board and advisory council service with various entities, including the Greater Dallas Chamber of Commerce | | | | | John S. Marr, Jr. | | – | | Chief Executive Officer of Tyler since 2004 | | | – | | Over 28 years of specific industry experience, including chief executive experience with MUNIS, Inc., which Tyler acquired in 1999 | | | – | | Outside board experience as a former director of Mercy Hospital in Portland, Maine | | | | | Dustin R. Womble | | – | | Senior-level executive experience at Tyler since 2003 | | | – | | Over 30 years of specific industry experience as founder of INCODE, Inc., which Tyler acquired in 1998 | | | | | John M. Yeaman | | – | | President of Tyler from 1998 through 2004 | | | – | | Over 19 years of public company executive experience at EDS |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS General InformationOur Board of Directors is responsible for supervision of the overall affairs of Tyler. To assist it in carrying out its duties, the Board has delegated certain authority to several committees. See “Board of Directors and Corporate Governance Principles – Committees and Meetings of the Board of Directors.” Following the annual meeting in 2012, the Board will continue to consist of seven directors, including four independent directors. Corporate Governance Guidelines Our boardBoard of directorsDirectors has adopted a number of corporate governance guidelines, including the following: Independence Standards, which determine the independence of our non-employee directors. These standards are consistent with the independence standards set forth in Rule 303A.02 of the New York Stock Exchange Listed Company Manual. The Independence Standards are included as an exhibit to our Audit Committee Charter. | • | | Independence Standards, which determine the independence of our non-employee directors. These standards are consistent with the independence standards set forth in Rule 303A.02(b) of the New York Stock Exchange Listed Company Manual. The Independence Standards are included as an exhibit to our Audit Committee Charter. | | | • | | Corporate Governance Guidelines, which include, among other things: |

Corporate Governance Guidelines, which include, among other things: | • | | annual submission of independent auditors to stockholders for approval; | | | • | | formation of a Nominating and Governance Committee to be comprised solely of independent directors; | | | • | | prohibition of stock option re-pricing; | | | • | | formalization of the ability of independent directors to retain outside advisors; | | | • | | performance of periodic formal board evaluation; and | | | • | | limitation on the number of additional public company boards on which a director may serve to a maximum of four. |

annual submission of independent auditors to stockholders for approval; | | | A copy of our Corporate Governance Guidelines may be found on our Website, www.tylertech.com. | | | • | | An Audit Committee Charter, which requires, among other things, that the committee be comprised solely of independent directors (as set forth in the Independence Standards), at least one of who will qualify as an “audit committee financial expert” as set forth in Item 401(h) of the SEC’s Regulation S-K. A copy of our Audit Committee Charter may be found on our Website, www.tylertech.com. | | | • | | A Compensation Committee Charter, which requires, among other things, that the committee be comprised solely of independent directors and sets forth the guidelines for determining executive compensation. A copy of our Compensation Committee Charter may be found on our Website, www.tylertech.com. | | | • | | A Nominating and Governance Committee Charter, which requires, among other things, that the committee be comprised of at least three independent directors who are responsible for recommending candidates for election to the board of directors. A copy of our Nominating and Governance Committee Charter may be found on our Website, www.tylertech.com. |

formation of a Nominating and Governance Committee to be comprised solely of independent directors; prohibition of stock option re-pricing; formalization of the ability of independent directors to retain outside advisors; performance of periodic formal Board evaluation; and limitation on the number of additional public company boards on which a director may serve to a maximum of four. A copy of our Corporate Governance Guidelines may be found on our Website, www.tylertech.com. An Audit Committee Charter, which requires, among other things, that the committee be comprised solely of independent directors (as set forth in the Independence Standards), at least one of whom will qualify as an “audit committee financial expert” as set forth in Item 401(h) of the SEC’s Regulation S-K. A copy of our Audit Committee Charter may be found on our Website, www.tylertech.com. A Compensation Committee Charter, which requires, among other things, that the committee be comprised solely of independent directors and sets forth the guidelines for determining executive compensation. A copy of our Compensation Committee Charter may be found on our Website, www.tylertech.com. A Nominating and Governance Committee Charter, which requires, among other things, that the committee be comprised of at least three independent directors who are responsible for recommending candidates for election to the Board of Directors. A copy of our Nominating and Governance Committee Charter may be found on our Website, www.tylertech.com.

Code of Business Conduct and Ethics Our boardBoard of directorsDirectors has adopted a Code of Business Conduct and Ethics, which applies to all of our directors, executive officers (including, without limitation, the chief executive officer, chief financial officer, principal accounting officer, and controller), and employees. The purpose of the Code of Business Conduct and Ethics is to promote: | • | | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; | | | • | | full, fair, accurate, timely, and understandable disclosure in our public communications and reports filed with the SEC; | | | • | | compliance with applicable governmental laws, rules, and regulations; | | | • | | prompt internal reporting of violations of the policy to the appropriate persons designated therein, including anonymous “whistleblower” provisions; and |

7

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely, and understandable disclosure in our public communications and reports filed with the SEC; compliance with applicable governmental laws, rules, and regulations; prompt internal reporting of violations of the policy to the appropriate persons designated therein, including anonymous “whistleblower” provisions; and accountability for adherence to the policy. A copy of our Code of Business Conduct and Ethics may be found on our Website,www.tylertech.com,, or will be furnished, without charge, upon written request at our principal executive offices. Any future amendments or waivers related to our Code of Business Conduct and Ethics will be promptly posted on our Website. Board Independence Our boardBoard of directorsDirectors has determined, after considering all of the relevant facts and circumstances, that each of the non-employee directors standing for re-election as director (Messrs. Brattain, King, Reeves, and Richards) has no material relationship with us (either directly or as a partner, shareholder,stockholder, or officer of an organization that has a relationship with us) and is “independent” within the meaning of our Independence Standards described above and the New York Stock Exchange director independence standards, as currently in effect and as may be changed from time to time. As a result, if each of the nominees for director is elected at the annual meeting, our boardBoard of directorsDirectors will be comprised of a majority of “independent” directors as required by the New York Stock Exchange. Furthermore, our boardBoard of directorsDirectors has determined that each of the members of the Audit Committee, Compensation Committee, and Nominating and Governance Committee has no material relationship with us (either directly or as a partner, shareholder,stockholder, or officer of an organization that has a relationship with us) and is “independent” within the meaning of our director independence standards. Committees and Meetings of the Board of Directors The board met seven times during 2008.Our Board of Directors has the following four standing committees: Audit Committee; Compensation Committee; Nominating and Governance Committee; and Executive Committee. Each committee (other than the Executive Committee) has a written charter, which may be found at our Website, www.tylertech.com. Each board member participated in at least 75% of all board and committee meetings held during the portion of 20082011 that he served as a director and/or committee member. During 2011, our Board of Directors held five meetings. In addition, our boardBoard of directorsDirectors has established a policy under which our non-management members will meet at regularly scheduled (and in any event at least twice per fiscal year) executive sessions without management present and with Mr. G. Stuart Reeves presiding over such meetings. During 2008, The table below provides current membership and 2011 meeting information for each of the standing committeescommittees: | | | | | | | | | Name | | Audit | | Compensation | | Nominating and

Governance | | Executive | Donald R. Brattain | | Chairman | | | | X | | | J. Luther King, Jr. | | X | | X | | | | | G. Stuart Reeves | | X | | X | | Chairman | | | Michael D. Richards | | | | Chairman | | X | | | John S. Marr, Jr. | | | | | | | | X | Dustin R. Womble | | | | | | | | X | John M. Yeaman | | | | | | | | Chairman | | | | | | Total Meetings in 2011 | | Four | | One | | One | | Periodically |

Below is a description of each committee. Each committee has authority to engage legal counsel or other advisors or consultants as it deems appropriate to carry out its responsibilities. Audit Committee.The Audit Committee assists the Board of Directors in its oversight of the quality and integrity of our board of directors were the Audit Committee, Compensation Committee, Executive Committee,accounting, auditing, and Nominating and Governance Committee. Audit Committee.During 2008, the Audit Committee was comprised of Donald R. Brattain (Chairman), J. Luther King, Jr., and G. Stuart Reeves, each of whom is “independent” as defined above.reporting practices. The Audit Committee’s duties include:role includes:considering the independence of our independent auditors before we engage them; | • | | considering the independence of our independent auditors before we engage them; | | | • | | reviewing with the independent auditors the fee, scope, and timing of the audit; | | | • | | reviewing the completed audit with the independent auditors regarding any significant accounting adjustments, recommendations for improving internal controls, appropriateness of accounting policies, appropriateness of accounting and disclosure decisions with respect to significant unusual transactions or material obligations, and significant findings during the audit; | | | • | | performance of periodic formal committee evaluations; | | | • | | reviewing our financial statements and related regulatory filings with the independent auditors; and | | | • | | meeting periodically with management to discuss internal accounting and financial controls. |

reviewing with the independent auditors the fee, scope, and timing of the audit; reviewing the completed audit with the independent auditors regarding any significant accounting adjustments, recommendations for improving internal controls, appropriateness of accounting policies, appropriateness of accounting and disclosure decisions with respect to significant unusual transactions or material obligations, and significant findings during the audit; performing periodic formal committee evaluations; reviewing our financial statements and related regulatory filings with management and the independent auditors; and meeting periodically with management and/or internal audit to discuss internal accounting and financial controls. The Audit Committee met five times during 2008. is responsible for the appointment, compensation, retention, and oversight of the independent auditor engaged to prepare or issue audit reports on our financial statements and internal control over financial reporting. The Audit Committee relies on the expertise and knowledge of management and the independent auditor in carrying out its oversight responsibilities. The Board of Directors has determined that each Audit Committee member is a non-management director who satisfies our Independence Standards and has sufficient knowledge in financial and auditing matters to serve on the Audit Committee. In addition, the Board of Directors has determined that Mr. Brattain and Mr. King are “audit committee financial experts” as defined by SEC rules.Compensation Committee. During 2008, the Compensation Committee was comprised of Michael D. Richards (Chairman), J. Luther King, Jr., and G. Stuart Reeves. The Compensation Committee has final authority onresponsibility for defining and articulating our overall compensation philosophy and administering and approving all executiveelements of compensation for elected corporate officers, including base salary, annual cash incentive compensation, and periodically reviews compensation and other benefits paid to or provided for our officers and directors.long-term equity incentive compensation. The Compensation Committee also approves annual salaries, stock option awardsreports to stockholders as required by the SEC. See “Compensation Discussion and bonuses for executive officers to ensure that the recommended salaries and bonuses are not unreasonable. TheAnalysis – Compensation Committee met twice during 2008.Report.” Members of the Compensation Committee are non-management directors who, in the opinion of the Board of Directors, satisfy our Independence Standards. For more information about the work of the Compensation Committee, see “Compensation Discussion and Analysis.” Nominating and Governance Committee.The Nominating and Governance Committee’s duties include: identifying and recommending candidates for election to our Board of Directors; identifying and recommending candidates to fill vacancies occurring between annual stockholder meetings; reviewing the composition of board committees; periodically reviewing the appropriate skills and characteristics required of board members in the context of the current make-up of our Board of Directors; and monitoring adherence to our “Corporate Governance Guidelines.” Executive Committee. During 2008, the Executive Committee was comprised of John M. Yeaman (Chairman), John S. Marr, Jr., and Dustin R. Womble. The Executive Committee has the authority to act for the entire boardBoard of 8

directors, Directors, but may not commit to an expenditure in excess of $5,000,000 without full board approval. Board Leadership Structure The roles of Chairman of the Board and Chief Executive Officer are separate with Mr. Yeaman serving as Chairman of the Board and Mr. Marr serving as President and Chief Executive Officer. We believe it is beneficial to separate the roles of Chief Executive Officer and Chairman of the Board to facilitate their differing roles in the leadership of Tyler. The role of the Chairman is to set the agenda for, and preside over, board meetings, as well as providing advice and assistance to the Chief Executive Officer. In contrast, the Chief Executive Officer is responsible for handling the day-to-day management direction of Tyler, serving as a leader to the management team, and formulating overall corporate strategy. Mr. Yeaman, as our Chairman and former Chief Executive Officer, brings over 13 years of experience within our industry as well as extensive expertise from outside Tyler, while Mr. Marr, as a director and our Chief Executive Officer, brings over 28 years of company-specific experience and expertise. We believe that this structure allows for a balanced corporate vision and an ability to effectively execute our strategy. The Board of Directors has concluded at this time that it is not necessary to establish a lead director. The Board’s Role in Risk Oversight Senior management is responsible for assessing and managing our various exposures to risk on a day-to-day basis, including the creation of appropriate risk management policies and programs. The Board of Directors is responsible for overseeing management in the execution of its responsibilities and for assessing our overall approach to risk management. The Board of Directors exercises these responsibilities periodically as part of its meetings and also through its committees, each of which examines various components of enterprise risk as part of its responsibilities. The Compensation Committee meets periodically throughoutis responsible for overseeing the year. Nominatingmanagement of risks relating to our executive compensation plans and Governance Committee.During 2008, the Nominatingarrangements. The Audit Committee oversees management of financial risks, as well as our policies with respect to risk assessment and Governance Committee was comprised of G. Stuart Reeves (Chairman), Donald R. Brattain, and Michael D. Richards. The Nominating and Governance Committee’s duties include:

| • | | identifying and recommending candidates for election to our board of directors; | | | • | | periodically reviewing the appropriate skills and characteristics required of board members in the context of the current make-up of our board; and | | | • | | monitoring adherence to our “Corporate Governance Guidelines”. |

risk management. The Nominating and Governance Committee met once during 2008. manages risks associated with board independence and potential conflicts of interest. In addition, an overall review of risk is inherent in the Board’s consideration of our long-term strategies and in the transactions and other matters presented to the Board, including capital expenditures, acquisitions and divestitures, and financial matters. The Board of Directors’ role in risk oversight is consistent with our leadership structure, with the Chief Executive Officer and other members of senior management having responsibility for assessing and managing our risk exposure, and the Board and its committees providing oversight in connection with these efforts.

Audit Committee Financial Expert Our boardBoard of directorsDirectors determined that each of Donald R. Brattain and J. Luther King, Jr., current chairman and member of the Audit Committee, respectively, possesses the attributes necessary to qualify as an “audit committee financial expert” as set forth in Item 401(h) of the SEC’s Regulation S-K. Pre-Approval Policies and Procedures for Audit and Non-Audit Services The Audit Committee Charter requires that the Audit Committee pre-approve all of the audit and non-audit services performed by our independent auditors. The purpose of these pre-approval procedures is to ensure that the provision of services by our independent auditors does not impair their independence. Each year, the Audit Committee receives fee estimates from our independent auditors for each category of services to be performed by the independent auditors during the upcoming fiscal reporting year. These categories of services include Audit Services, Audit-Related Services, Tax Services, and All Other Services. Upon review of the types of services to be performed and the estimated fees related thereto, the Audit Committee will determine which services and fees should be pre-approved, which pre-approval will be in effect for a period of twelve months. The Audit Committee may periodically review the list of pre-approved services based on subsequent determinations. Unless a type of service to be provided by the independent auditor has received general pre-approval, it will require specific pre-approval by the Audit Committee (or delegated member of the Audit Committee) prior to the performance of such service. Any proposed services exceeding the pre-approved cost levels will also require specific pre-approval by the Audit Committee (or delegated member of the Audit Committee). Director Nominating Process The Nominating and Governance Committee is responsible for reviewing and interviewing qualified candidates to serve on our boardBoard of directorsDirectors and to select both “independent” as well as management nominees for director to be elected by our stockholders at each annual meeting. The Nominating and Governance Committee is comprised solely of independent directors and operates under a Charter for the Nominating and Governance Committee. Our Corporate Governance Guidelines include the criteria our boardBoard of directorsDirectors believes are important in the selection of director nominees, which includes the following qualifications: | • | | sound personal and professional integrity; | | | • | | an inquiring and independent mind; | | | • | | practical wisdom and mature judgment; | | | • | | broad training and experience at the policy-making level of business, finance and accounting, government, education, or technology; | | | • | | expertise that is useful to Tyler and complementary to the background and experience of other board members, so that an optimal balance of board members can be achieved and maintained; | | | • | | willingness to devote the required time to carrying out the duties and responsibilities of board membership; | | | • | | commitment to serve on the board for several years to develop knowledge about our business; |

9

| • | | willingness to represent the best interests of all stockholders and objectively appraise management performance; and | | | • | | involvement only in activities or interests that do not conflict with the director’s responsibilities to Tyler or our stockholders. |

The Nominating and Governance Committee may, in the exercise of its discretion, actively solicit nominee candidates; however, nominee recommendations submitted by other directors or stockholders will also be considered as described below. The Nominating and Governance Committee will consider qualified nominees recommended by stockholders who may submit recommendations to the committee in care of our Corporate Secretary at our corporate headquarters, 5949 Sherry Lane, Suite 1400, Dallas, Texas 75225. To be considered by the Nominating and Governance Committee, stockholder nominations must be submitted in accordance with our bylaws and must be accompanied by a description of the qualifications of the proposed candidate and a written statement from the proposed candidate that he or she is willing to be nominated and desires to serve, if elected. Nominees for director who are recommended by our stockholders will be evaluated in the same manner as any other nominee for director. Nominations by stockholders may also be made at an annual meeting of stockholders in the manner provided in our bylaws. Our bylaws require that a stockholder entitled to vote for the election of directors may make nominations of persons for election to our board at a meeting of stockholders by complying with required notice procedures. Nominations must be received at our corporate headquarters not less than 75 days or more than 85 days before any annual meeting of stockholders. If, however, notice or prior public disclosure of an annual meeting is given or made less than 75 days before the date of the annual meeting, the notice must be received no later than the 10th day following the date of mailing of the notice of annual meeting or the date of public disclosure of the date of the annual meeting, whichever is earlier. The notice must specify the following: as to each person the stockholder proposes to nominate for election or re-election as a director: the name, age, business address, and residence address of the person; | • | | the name, age, business address, and residence address of the person; | | | • | | the principal occupation or employment of the person; | | | • | | the class and number of shares of our capital stock that are beneficially owned by the person; and | | | • | | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors under Regulation 14A of the Exchange Act; and |

the principal occupation or employment of the person; the class and number of shares of our capital stock that are beneficially owned by the person; and any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors under Regulation 14A of the Exchange Act; and as to the stockholder giving notice: the name and record address of the stockholder and any other stockholder known to be supporting the nominee; and | • | | the name and record address of the stockholder and any other stockholder known to be supporting the nominee; and | | | • | | the class and number of shares of our capital stock that are beneficially owned by the stockholder making the nomination and by any other supporting stockholders. |

the class and number of shares of our capital stock that are beneficially owned by the stockholder making the nomination and by any other supporting stockholders. We may require that the proposed nominee furnish us with other information as we may reasonably request to assist us in determining the eligibility of the proposed nominee to serve as a director. At any meeting of stockholders, the presiding officer may disregard the purported nomination of any person not made in compliance with these procedures. Communications with Our Board of Directors Any stockholder or interested party who wishes to communicate with our boardBoard of directorsDirectors or any specific directors, including non-management directors may write to: Board of Directors

Tyler Technologies, Inc.

5949 Sherry Lane, Suite 1400

Dallas, Texas 75225 10

Depending on the subject matter, management will: forward the communication to the director or directors to whom it is addressed (for example, if the communication received deals with our “whistleblower policy” found on our Website, www.tylertech.com, including questions, concerns, or complaints regarding accounting, internal accounting controls, and auditing matters, it will be forwarded by management to the Chairman of the Audit Committee for review); | • | | forward the communication to the director or directors to whom it is addressed (for example, if the communication received deals with our “whistleblower policy” found on our Website,www.tylertech.com, including questions, concerns, or complaints regarding accounting, internal accounting controls, and auditing matters, it will be forwarded by management to the Chairman of the Audit Committee for review); | | | • | | attempt to handle the inquiry directly (for example, if the communication is a request for information about us or our operations or it is a stock-related matter that does not appear to require direct attention by our board of directors); or | | | • | | not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

attempt to handle the inquiry directly (for example, if the communication is a request for information about us or our operations or it is a stock-related matter that does not appear to require direct attention by our Board of Directors); or not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. At each meeting of our boardBoard of directors,Directors, our Chairman will present a summary of all communications received since the last meeting of the boardBoard of directorsDirectors that were not forwarded and will make those communications available to any director on request. Director Attendance at Annual Meetings Directors are not required to attend our annual meetings of stockholders. However, our boardBoard of directorsDirectors typically holds a meeting immediately following the annual meeting of stockholders. Therefore, in most cases, all of our directors will be present at the annual meeting. All of our directors were present at the 20082011 annual meeting of stockholders. 11

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth certain information concerning the beneficial ownership of our common stock as of March 17, 200916, 2012 by (i) each beneficial owner of more than 5% of our common stock, (ii) each director and nominee, (iii) each “Named Executive Officer” (as defined in the SEC’s Regulation S-K), and (iv) all of our executive officers and directors as a group. Security Ownership of Directors and Management | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Options | | | | | | | | | | | | | | | | | | Exercisable | | | | | | | | | | | | | | | | | | Within 60 | | | | | | | | | | Percent | | Name and Address of Beneficial Owner (1) | | Direct (2) | | Days (3) | | Other (4) | | Total | | of Class (5) | | | | | | | | | | | | | | | | | | | | | | | | MSD Capital, L.P. | | | 4,049,923 | (6) | | | — | | | | — | | | | 4,049,923 | | | | 11.5 | % | | 645 Fifth Avenue, 21st Floor | | | | | | | | | | | | | | | | | | | | | | New York, NY 10022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Brown Brothers Harriman and Company | | | 3,485,013 | (7) | | | — | | | | — | | | | 3,485,013 | | | | 9.9 | % | | 140 Broadway | | | | | | | | | | | | | | | | | | | | | | New York City, NY 10005 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Barclays PLC | | | — | | | | — | | | | 2,359,357 | (8) | | | 2,359,357 | | | | 6.7 | % | | 400 Howard Street | | | | | | | | | | | | | | | | | | | | | | San Francisco, CA 94105 | | | | | | | | | | | | | | | | | | | | | | | | Vaughn Nelson Investment Management, L.P. | | | — | | | | — | | | | 2,292,609 | (9) | | | 2,292,609 | | | | 6.5 | % | | 600 Travis Street, Suite 6300 | | | | | | | | | | | | | | | | | | | | | | Houston, TX 77002 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Artisan Partners Limited Partnership | | | — | | | | — | | | | 1,800,800 | (10) | | | 1,800,800 | | | | 5.1 | % | | 875 East Wisconsin Avenue, Suite 800 | | | | | | | | | | | | | | | | | | | | | | Milwaukee, WI 53202 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Directors and Nominees | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Donald R. Brattain | | | 28,500 | | | | 33,333 | | | | — | | | | 61,833 | | | | * | | | J. Luther King, Jr. | | | 32,000 | | | | 33,333 | | | | 187,300 | (11) | | | 252,633 | | | | * | | | G. Stuart Reeves | | | 65,000 | | | | 123,333 | | | | — | | | | 188,333 | | | | * | | | Michael D. Richards | | | 40,000 | | | | 43,333 | | | | — | | | | 83,333 | | | | * | | | John M. Yeaman | | | 276,300 | | | | 469,000 | | | | 7,300 | (12) | | | 752,600 | | | | 2.1 | % | | | | | | | | | | | | | | | | | | | | | | | Named Executive Officers | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | John S. Marr, Jr. | | | 1,027,092 | | | | 664,000 | | | | 192,277 | (13) | | | 1,883,369 | | | | 5.2 | % | | Dustin R. Womble | | | 174,301 | | | | 343,628 | | | | — | | | | 517,929 | | | | 1.5 | % | | Brian K. Miller | | | 27,504 | | | | 105,000 | | | | 7,300 | (14) | | | 139,804 | | | | * | | | H. Lynn Moore, Jr. | | | 80,000 | | | | 110,000 | | | | — | | | | 190,000 | | | | * | | | | | | | | | | | | | | | | | | | | | | | | | All directors, nominees and executive officers as a group (9 persons) | | | 1,750,697 | | | | 1,924,960 | | | | 394,177 | | | | 4,069,834 | | | | 10.9 | % |

| | | | | | | | | | | | | | | | | | | | | Name and Address of Beneficial Owner (1) | | Direct (2) | | | Options

Exercisable

Within 60

Days (3) | | | Other (4) | | | Total | | | Percent of

Class (5) | | Brown Capital Management, LLC | | | | | | | | | | | | | | | | | | | | | 1201 N. Calvert Street | | | | | | | | | | | | | | | | | | | | | Baltimore, MD 21202 | | | 3,230,603 | (6) | | | — | | | | — | | | | 3,230,603 | | | | 10.7 | % | | | | | | | Brown Brothers Harriman & Co. | | | | | | | | | | | | | | | | | | | | | 140 Broadway | | | | | | | | | | | | | | | | | | | | | New York City, NY 10005 | | | — | | | | — | | | | 2,854,179 | (7) | | | 2,854,179 | | | | 9.5 | % | | | | | | | BlackRock, Inc. | | | | | | | | | | | | | | | | | | | | | 40 East 52nd Street | | | | | | | | | | | | | | | | | | | | | New York, NY 10022 | | | 2,177,891 | (8) | | | — | | | | — | | | | 2,177,891 | | | | 7.2 | % | | | | | | | Columbia Wanger Asset Management, LLC | | | | | | | | | | | | | | | | | | | | | 227 West Monroe Street, Suite 3000 | | | | | | | | | | | | | | | | | | | | | Chicago, IL 60606 | | | 1,821,000 | (9) | | | — | | | | — | | | | 1,821,000 | | | | 6.1 | % | | | | | | | Directors and Nominees | | | | | | | | | | | | | | | | | | | | | Donald R. Brattain | | | 28,500 | | | | 19,999 | | | | — | | | | 48,499 | | | | * | | J. Luther King, Jr. | | | 32,000 | | | | 49,999 | | | | 187,300 | (10) | | | 269,299 | | | | * | | G. Stuart Reeves | | | 34,000 | | | | 39,999 | | | | — | | | | 73,999 | | | | * | | Michael D. Richards | | | 50,000 | | | | 39,999 | | | | — | | | | 89,999 | | | | * | | John M. Yeaman | | | 324,347 | | | | 226,166 | | | | 7,300 | (11) | | | 557,813 | | | | 1.8 | % | | | | | | | Named Executive Officers | | | | | | | | | | | | | | | | | | | | | John S. Marr, Jr. | | | 646,092 | | | | 758,000 | | | | 192,277 | (12) | | | 1,596,369 | | | | 5.2 | % | Dustin R. Womble | | | 172,489 | | | | 623,628 | | | | — | | | | 796,117 | | | | 2.6 | % | Brian K. Miller | | | 20,389 | | | | 235,485 | | | | 7,300 | (13) | | | 263,174 | | | | * | | H. Lynn Moore, Jr. | | | 24,039 | | | | 279,000 | | | | — | | | | 303,039 | | | | * | | All directors, nominees and executive officers as a group (9 persons) | | | 1,331,856 | | | | 2,272,275 | | | | 394,177 | | | | 3,998,308 | | | | 12.4 | % |

| | | | * | | Less than one percent of our outstanding common stock | |

| (1) | | Unless otherwise noted, the address of each beneficial owner is our corporate headquarters: 5949 Sherry Lane, Suite 1400, Dallas, Texas 75225. |

12

| | | | (2) | | “Direct” represents shares as to which each named individual has sole voting or dispositive power. | |

| (3) | | “Options Exercisable Withinwithin 60 Days” reflects the number of shares that could be purchased by exercise of options at March 17, 200916, 2012 or within 60 days thereafter. | |

| (4) | | “Other” represents the number of shares of common stock as to which the named individualsentity or individual share voting and dispositive power with another personentity or trust fund.individual(s). | |

| (5) | | Based on 35,252,63030,084,000 shares of our common stock issued and outstanding at March 17, 2009.16, 2012. Each stockholder’s percentage is calculated by dividing (a) the number of shares beneficially owned by (b) the sum of (i) 35,252,63030,084,000 plus (ii) the number of shares such owner has the right to acquire within sixty60 days. | |

| (6) | | Based on information reported by MSDBrown Capital L.P.Management, LLC on aAmendment No. 4 to Schedule 13G that was filed with the SEC on or about February 3, 2006.13, 2012. Brown Capital Management, LLC is deemed to have beneficial ownership of these shares, which includes sole voting power of 1,880,234 shares and sole investment power for all 3,230,603 shares. | |

| (7) | | Based on information reported by Brown Brothers Harriman and Company& Co. on a Schedule 13G that was filed with the SEC on or about February 17, 2009. | | (8) | | Barclays PLC is deemed to have beneficial ownership of these shares. The shares are held by Barclays’ affiliates, Barclays Global Investors, NA., Barclays Global Fund Advisors and Barclays Global Investors, LTD and are based on information reported on a Schedule 13G that was filed with the SEC on or about February 5, 2009. Barclays PLC beneficial ownership includes 1,959,389 shares for which they have sole voting and sole investment power and 399,968 shares for which they have sole investment power. | | (9) | | Based on information reported by Vaughn Nelson Investment Management, L.P., on a Schedule 13G that was filed with the SEC on or about February 17, 2009. Vaughn Nelson Investment Management, L.P. beneficial ownership includes 1,603,425 shares for which they have sole voting and sole investment power, 473,609 shares for which they have shared investment power and 215,575 shares for which they have sole investment power. | | (10) | | Based on information reported by Artisan Partners Limited Partnership on a Schedule 13F that was filed with the SEC on or about February 13, 2009. Artisan Partners Limited Partnership’s15, 2012. Brown Brothers Harriman & Co. is deemed to have beneficial ownership of these shares, which includes 1,652,400shared voting and investment power for all 2,854,179 shares. |

| (8) | Based on information reported by BlackRock, Inc. on Amendment No. 1 to Schedule 13G that was filed on or about February 10, 2012. BlackRock, Inc. is deemed to have beneficial ownership of these shares, for which they have sharedincludes sole voting and sole investment power and 148,400for all 2,177,891 shares. |

| (9) | Based on information reported by Columbia Wanger Asset Management, LLC on a Schedule 13G that was filed on or about February 13, 2012. Columbia Wanger is deemed to have beneficial ownership of these shares, for which they haveincludes sole voting power of 1,733,000 shares and sole investment power.power for all 1,821,000 shares. |

| (11) | (10) | Includes the beneficial ownership of 180,000 shares of common stock held in an entity controlled by Mr. King andin which he is deemed to have voting and investment power, and 7,300 shares of common stock owned by a foundation in which Mr. King is deemed to have shared voting power. |

| (12) | (11) | Common stock owned by a foundation in which Mr. Yeaman is deemed to have shared voting power. |

| (13) | (12) | Common stock held by a partnership in which Mr. Marr is the general partner and has sole voting and investment power. |

| (14) | (13) | Common stock owned by a foundation in which Mr. Miller is deemed to have shared voting power. |

13